November 23 – RBA Ends 2024 on the Narrow Path

RBA Recap

- The RBA implemented a series of rate hikes throughout 2023, resulting in a total increase of 425 basis points over 19 months. This had a significant impact on the Australian economy.

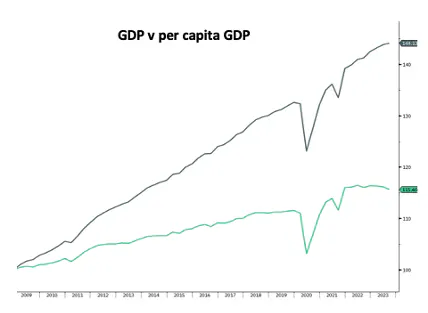

- Despite a recession in per capita GDP and a drop in the household savings ratio to its lowest level since the Global Financial Crisis (1.1%), Australia's overall economy benefited from population growth, primarily due to increased post-pandemic net migration.

Anticipations for 2024

The year ahead is expected to witness a tension between a declining per capita economy and the counterbalancing effect of population growth.

- In December, the RBA decided to keep interest rates steady at 4.35%, a decision influenced by data indicating a considerable economic slowdown in the third quarter, including minimal GDP growth.

- Despite a decrease in retail sales and household discretionary spending, the influx of immigrants has obscured the decline in per capita spending.

- Consumer confidence has shown a marginal improvement but remains at its second-lowest level in the past 50 years, indicating potential challenges for the Australian economy in 2024.

Market Dynamics

- There has been an increased demand for funds in the banking sector since mid-November, continuing into December. This is attributed to the desire for strong liquidity buffers during the holiday season.

- Changes in liquidity standards might lead to a shift from traditional bank-to-bank transactions to non-bank funding counterparts, particularly with the rising focus on ESG-friendly investments.

Author:

Charles Kirk

Get in Touch

Start a Conversation with an Up Funds Management Adviser today.

'Shaping Generational Financial Fortunes'

10 years +

Proud History & Heritage

270

Advisers

$18bn+ AUM

Assets Under Management