Looking Ahead to 2024: A Complex Outlook

Key Highlights

- Global economic growth faced challenges in 2023, leading to technical recessions in several economies. Mega-cap technology companies dominated equity market returns, while other asset classes remained relatively stable.

- The outlook for 2024 remains highly uncertain. While there is still a significant chance of a recession in the US, other possibilities include a rebalancing without a recession or a continuation of the current economic cycle.

- Market sentiment appears to assign a low probability to either a recession or a continuation of the current cycle. This suggests there may be opportunities for a tactical approach from a contrarian perspective.

As we approach 2024, our annual Market Insight reflects on the accuracy of our previous year's predictions and explores the outlook for the year ahead. 2023 proved to be a perplexing year, defying consensus expectations, including our own, set at the close of 2022. The prevailing belief was that major global economies would experience a minor recession in 2023 due to monetary policy tightening. As a result, investors and ourselves tilted portfolios away from equities, a logical stance given the anticipated economic downturn.

However, reality painted a more nuanced picture. While global economic growth did decelerate, leading to "technical" recessions in numerous countries, the United States exhibited remarkable resilience. Additionally, technology companies surged, buoyed by optimism surrounding artificial intelligence (AI), providing substantial support to global equity markets throughout the year.

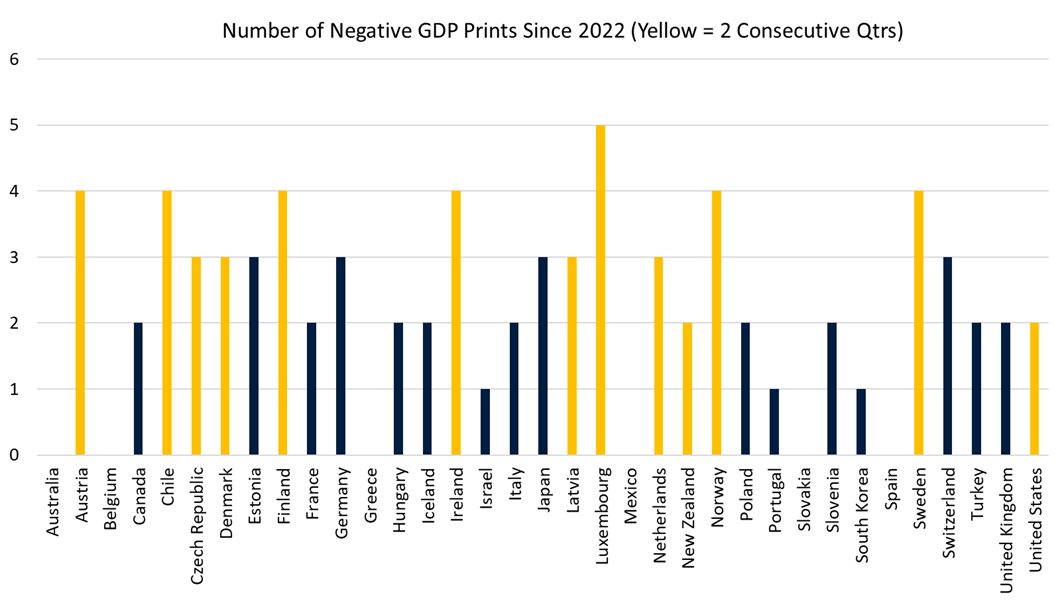

Among the 35 largest OECD countries, nearly 40% endured two consecutive quarters of economic decline since 2022. Remarkably, only a handful of nations, including Australia, saw consistent growth over the past two years, although Australia experienced a per-capita recession.

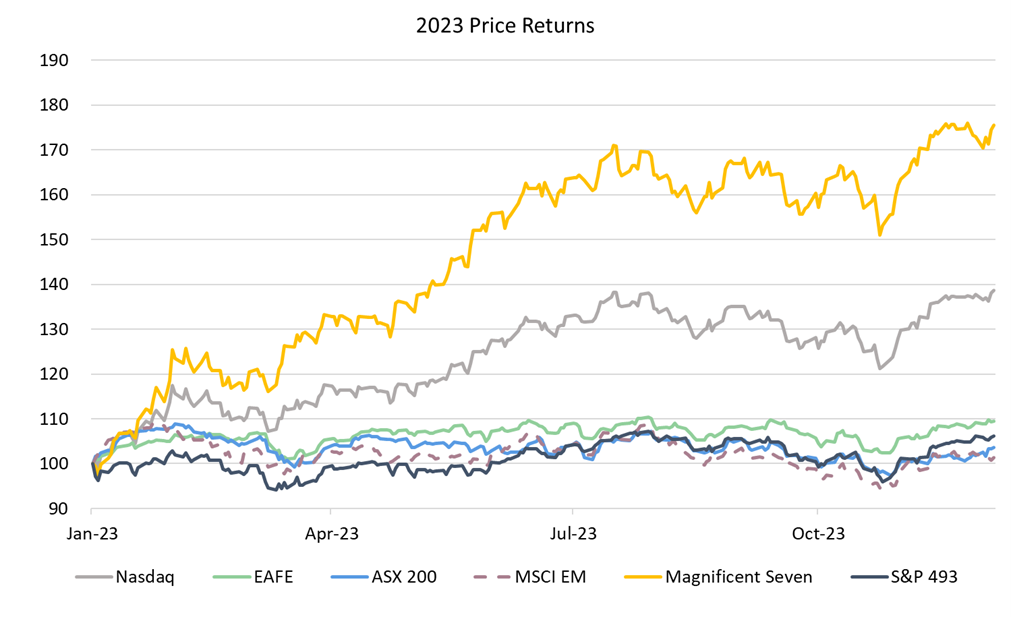

The relative performance across different equity markets in 2023 can be attributed to this complex economic backdrop. The year's performance was overwhelmingly dominated by seven mega-cap technology companies, often referred to as the "Magnificent Seven." In price terms, these companies saw around a 75% increase from a market cap-weighted perspective. Excluding these, the S&P 500 recorded only a 6% gain, comparable to Australia and Europe, outperforming emerging markets, which remained largely stagnant. It is essential to note that beyond the Magnificent Seven, equities struggled to reach all-time highs due to lackluster returns in 2022.

Looking ahead to the next year, the outlook is fraught with uncertainty. Several reasonably likely scenarios for 2024 can be considered:

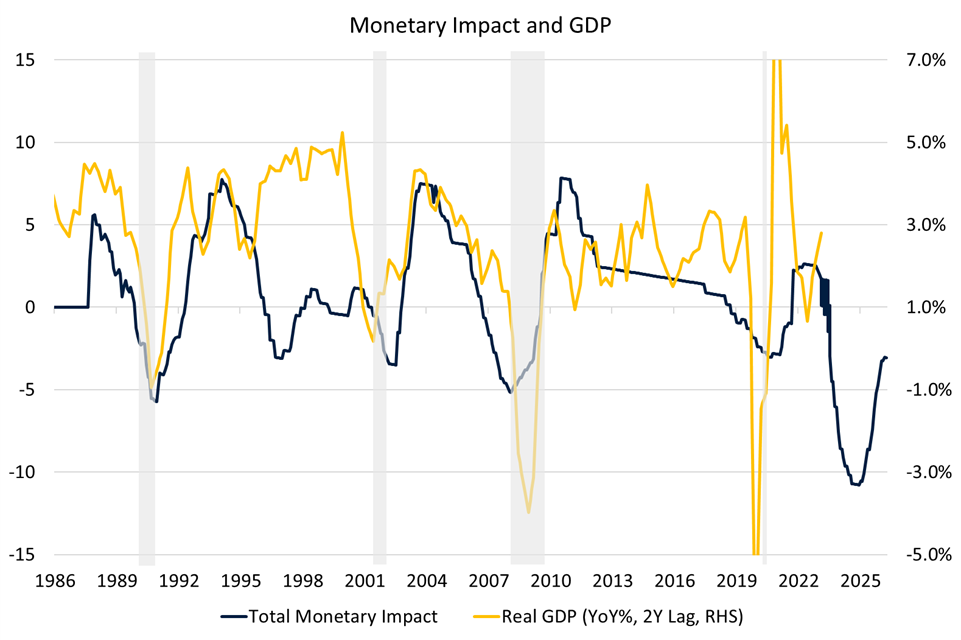

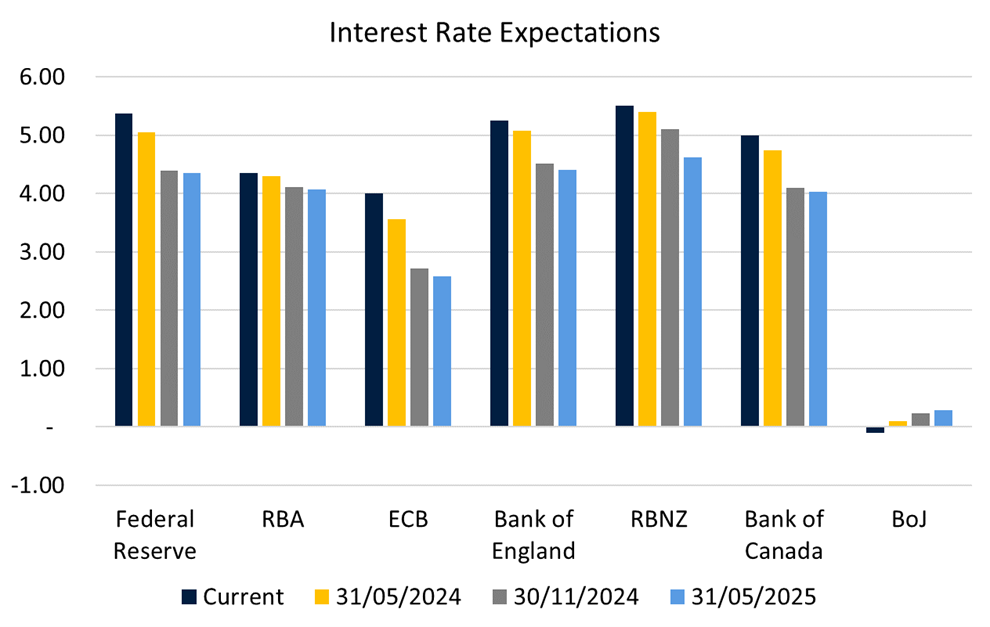

1. **Recession in the US**: Although the US has yet to officially enter a recession, there is still a possibility given the delayed effects of monetary policy. Bank lending standards continue to tighten, suggesting limited support for growth in the coming year. Equity markets are likely to perform poorly if a recession occurs, with central banks expected to cut rates. However, any market reaction may be less severe than historical norms, given the current market valuations and the Federal Reserve's readiness to intervene.

2. **Re-balancing without Recession**: In this scenario, inflation moderates, economic growth slows but remains positive, and central banks lower rates as they feel less pressure to restrict growth. This is the scenario the market appears to be pricing, with major equity markets far from their lows. If this scenario unfolds, equities could rally further, driven by lower bond yields and a potential reacceleration in economic growth.

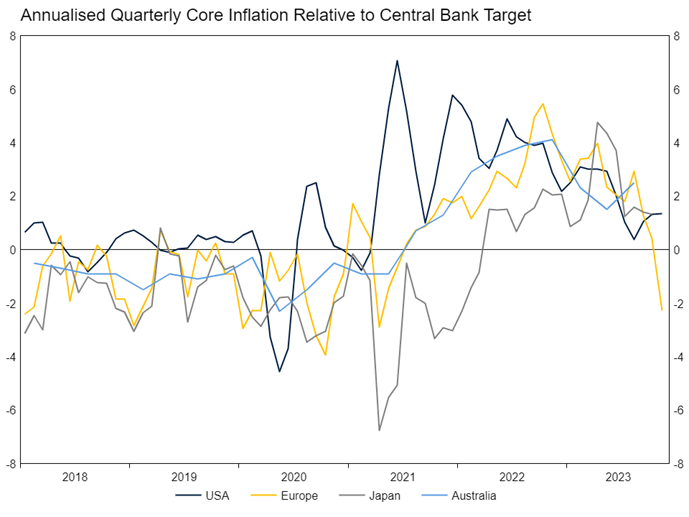

3. **The Cycle Continues**: Inflation remains high in most major economies, making central banks hesitant to cut rates. Equities may perform poorly, with higher long-term bond yields and renewed concerns about a future recession, albeit not until 2025. While this is the least likely scenario, it still warrants consideration.

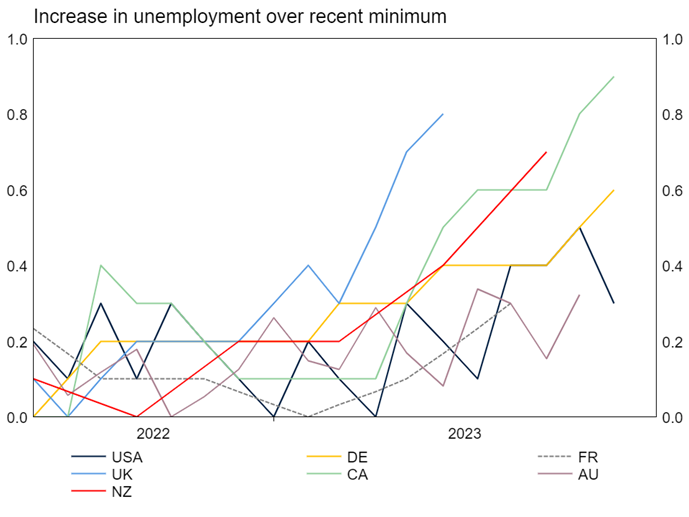

Balancing these probabilities, the first scenario (Recession in the US) remains the most likely, but it is by no means guaranteed. This tightening monetary policy cycle, starting from a considerable distance away from the inflation target, is unprecedented. Additionally, some signs suggest a gradual slowdown in growth. One key indicator to watch is labor markets, which have begun to show signs of stress in many economies. Historically, rising unemployment has led to economic pullbacks and recessions.

However, it is crucial to recognize the strength in household balance sheets, particularly in the US, where most mortgage holders still enjoy low 30-year fixed rates. Furthermore, the government's significant fiscal deficits have bolstered the economy. The Federal Reserve's crisis management skills have also contributed to market stability, as exemplified by the prompt resolution of the banking crisis in March 2023.

**Portfolio Positioning**: With the possibility of any of these scenarios unfolding in 2024, portfolio positioning should consider market expectations. The market appears to anticipate the second scenario (Rebalancing without Recession). Practically, this means that if any of the other two scenarios materialize, markets are likely to adjust significantly from their current positions. From a tactical standpoint, missing out on performance from underweighting equities in a Rebalancing without Recession scenario carries lower risk than being overweight equities if a recession occurs. Nevertheless, the fluid situation suggests that portfolio positioning may shift as we gain clarity in the near term.

Author:

Paul Wilkinson

Get in Touch

Start a Conversation with an Up Funds Management Adviser today.

'Shaping Generational Financial Fortunes'

10 years +

Proud History & Heritage

270

Advisers

$18bn+ AUM

Assets Under Management