Corporate Finance

Up Funds Management Corporate Finance delivers top-tier services across a broad range of capital market financing, mergers and acquisitions, and aftermarket support.

Expertise

A Legacy of Excellence

The executives at Up Funds Management Corporate Finance bring years of global investment banking and commercial experience. For each assignment, we assemble a team with diverse professional backgrounds, including finance, engineering, law, accounting, retail, agriculture, and management consulting.

Capabilities

Up Funds Management Corporate Finance excels in providing services across capital market financing, mergers & acquisitions, and aftermarket support.

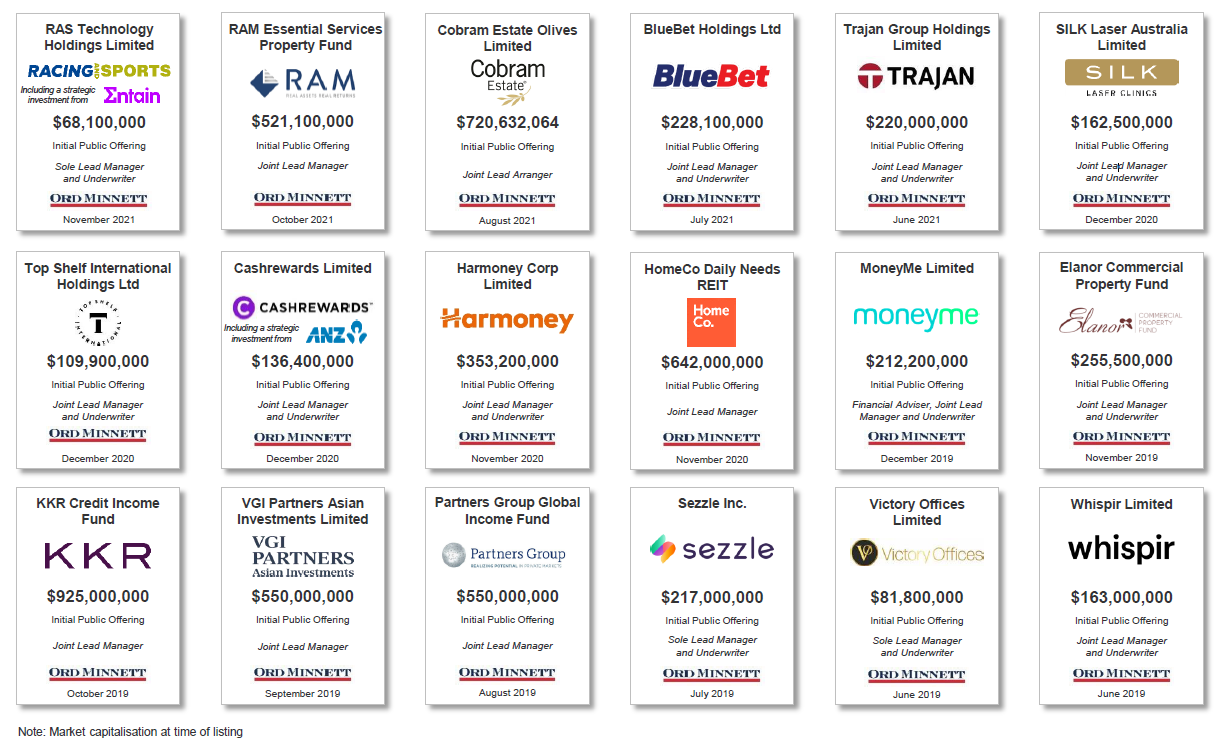

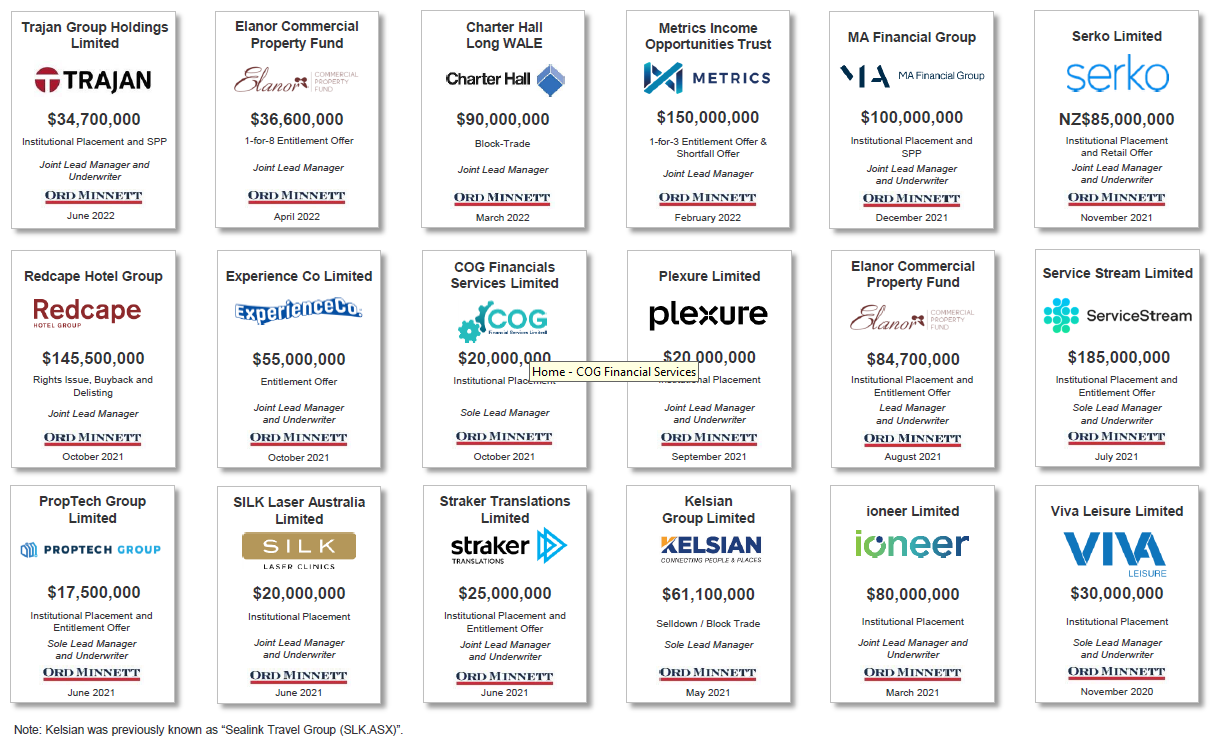

We specialize in underwriting and advising companies looking to raise capital through:

- ASX IPOs

- Pre-IPOs

- Secondary raisings for listed companies (institutional placements, share purchase plans, entitlement offers, selldowns, and block trades)

- Unlisted growth capital

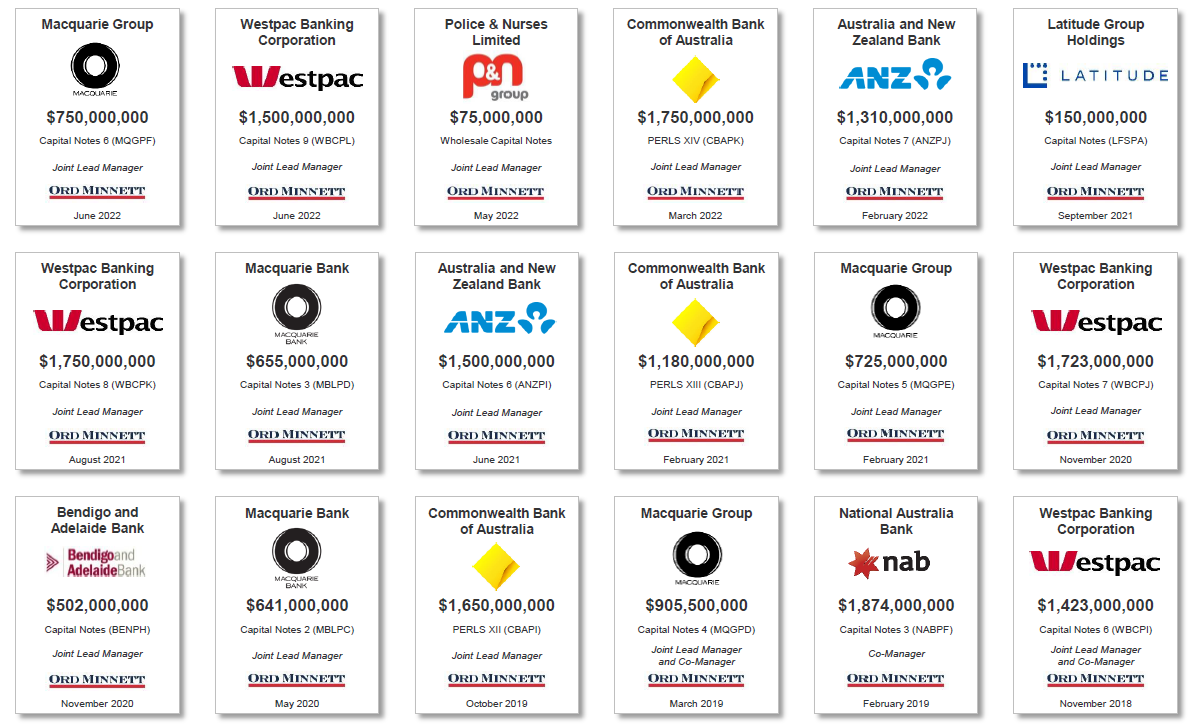

We also offer equity and equity-linked security issuance capabilities (convertible notes), and originate, structure, execute, and distribute fixed income/hybrid capital (convertible preference shares, subordinated notes, and capital notes).

We provide advisory and evaluation services for capital requirements, including:

- Analysis of optimal capital structure

- Review of funding options

- Execution of capital management strategies

- Negotiation with senior and junior lenders

We assist in corporate strategy development, business plans, industry analysis, competitive positioning, and shareholder communication strategies, along with investor identification, engagement, and education. We also offer board structuring advice and access to a proprietary database of executive & non-executive director candidates.

- Advisory on public market takeovers and defense

- Strategic advisory for divestitures and joint ventures

- Identification, review, and strategy for targets/acquirers

- Transaction structuring, negotiation, due diligence, risk analysis, valuation, financing, and execution

- Defense preparation, offer analysis, response strategy, and corporate valuation

- White knight search and engagement

We offer comprehensive and well-resourced emerging company coverage in the Australian market, including complete investor coverage across institutional investors, family offices, high-net-worth individuals, and retail investors, both in Australia and internationally.

Our multi-channel aftermarket support includes:

- Market commentary & trade activity analysis

- Domestic & international roadshows

- Investor conferences & media relations

- Presentations to the Up Funds Management network

We provide proprietary research from our experienced team of equity research analysts and investment strategists, supplemented by access to global institutional research.

Up Funds Management's equity research was ranked #1 Emerging Company Focused Broker and #2 Overall for Small Cap Priority Accounts in 2019.

Research Platform Overview

- Proprietary research from our in-house team renowned for their coverage of emerging ASX-listed stocks

- Ranked as the #1 Emerging Company Focused Broker and #2 overall for Small Cap Priority Accounts in 2019

- Recognized as the Most Improved for All Investors Small Cap Stock Research from 2017 to 2019

- Coverage of over 80 emerging companies across various sectors

- A shorter 'black out' period of 14 days compared to most US-operating investment banks

Get in Touch

Start a Conversation with Up Funds Management Corporate Finance today.

'Best-in-Class advice to clients'